Even if your new year started with a bang, you may now be quietly fretting the financial goals you set for yourself and how to achieve them. Thankfully, you are not alone.

“Money can be a very difficult subject for some people,” says Chad Wolfe, a Money Coach and Student Loan Specialist at My Secure Advantage, a financial coaching program offered to T-Mobile employees through the company’s LiveMagenta well-being website. “Things change each year, and it can be overwhelming.”

One change that can make things less overwhelming, he says, is the new financial responsibility trend called “loud budgeting,” which has taken social media by storm and aims to eradicate the isolation people may feel when it comes to money challenges.

Loud budgeting is about being outspoken when it comes to your financial decisions and when saying no to things that don’t align with your goals. It’s not just declining your friends’ invitation to join in on an expensive night out but also honestly explaining why it distracts you from your goals. This trend empowers you to set boundaries and achieve financial wellness with emotional comfort, Wolfe says.

“I think if you can find a sense of community that allows you that freedom to be honest about your goals and things you may not be doing to work toward those goals, that’s great,” Wolfe says. “I like to think of it as replacing ‘FOMO,’ or the ‘fear of missing out,’ with ‘JOMO,’ or the ‘joy of missing out.’”

A Cultural Shift: Loud Budgeting in Action

Giovanna González, a Gen Z-focused financial educator and best-selling author, is an early adopter of loud budgeting. In her book Cultura & Cash, she provides practical and jargon free advice for fellow first-generation Latinas as well as students and young professionals to confidently manage money, pay off debt, build generational wealth and gain financial freedom.

“The language you use matters,” González says. “Instead of saying ‘I can’t afford that’ try saying ‘that’s not a priority for me right now.’ It shifts the emotion of spending money from a place of shame and scarcity, to feeling in control and clear on your financial goals.”

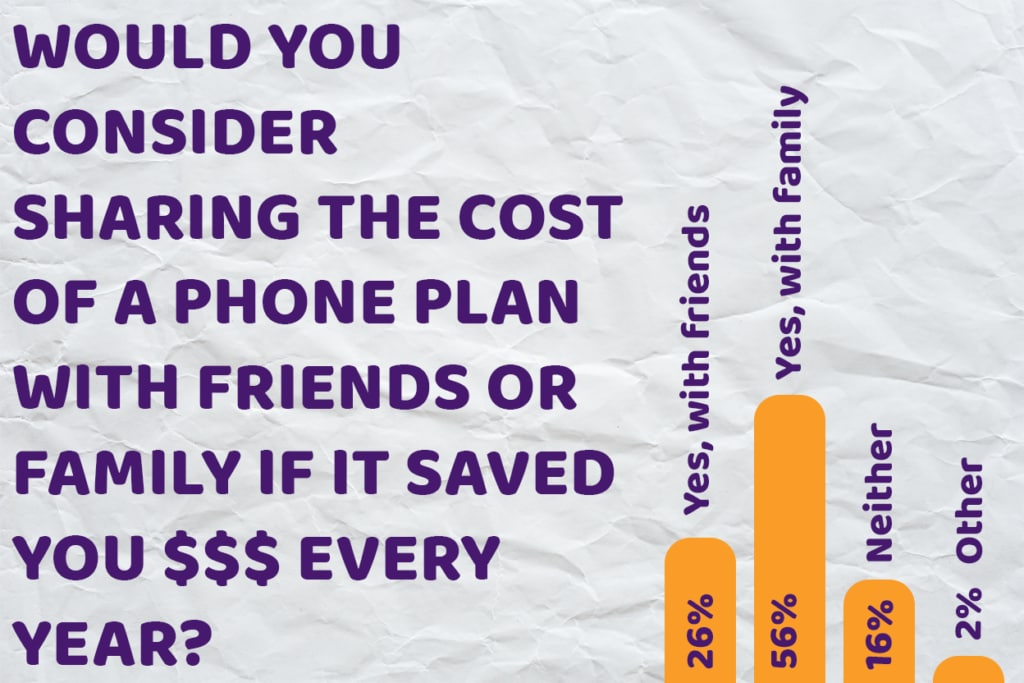

Community support can be key to achieving financial goals, she says. González recently polled users on social media if they would consider sharing a plan with friends and family to save on a new phone or the cost per line. The response was overwhelmingly positive, with 82% of respondents saying they would. In fact, 63% said they already share a phone plan, and 71% of poll participants said they’ve held onto an old or faulty phone for longer than they wanted because of the cost to replace it.

“The poll results are in line with my own experience,” González shares. “I shared a phone plan with my mom and two siblings for five years to save on expenses.”

In that spirit, Metro by T-Mobile has deals that can help you save. For example, the “Four Samsung Galaxy A16 5Gs on Us” deal offers customers four lines for just $120/month with AutoPay ($125 for the first month), and the fourth line is free with zero activation fees when you sign up for Metro Flex Start. This deal can save a family or group of friends $420 per year on their plan, with a combined value of over $1,300 for the four phones and free fourth line for a year.

Stretch Your Dollar with Smart Savings

Over the years, Wolfe has shared numerous tips on budgeting, from building an emergency fund to tackling high-interest debt and maximizing IRA contributions. Now, he emphasizes that being vocal about your financial goals — and cleverly saving to achieve them — can contribute to your bottom line.

“That Metro savings of $420 per year could go towards debt you’re paying down,” he says, underscoring how it’s important to get out of the red to achieve financial goals.

Wolfe also says people should be checking where to bundle expenses for a discount (a tip he shared last year as well). According to Forbes, the average American spends $46 per month on streaming services. Rather than cancel subscriptions, bundling is an easier and more convenient way to save while still enjoying entertainment. Metro Flex Plus customers, for example, get access to an Amazon Prime membership as part of their plan for a savings of $14.99 per month. Not to mention other perks every week through T-Mobile Tuesdays via the T-Life app like discounted movie tickets, Shell fuel rewards at the gas pump and so much more.

With a little loud budgeting and the help of great plans like Metro Flex Plus, you can find creative ways to get what you want while staying on track with your financial goals.

Want more information on how to get the most out of one of Samsung’s newest smartphones, with lightning-fast speeds on the nation’s fastest prepaid network? Check out the latest offers when you sign up for Metro Flex Plus at Metro stores nationwide. By embracing loud budgeting and leveraging these kinds of innovative offers, you can achieve your financial goals while staying connected.

Here’s how it works: You’ll need email, ID (to verify your name & address), and to bring your number to sign up. 4 lines required. Discount ends if you move plans or cancel any lines. Not available if you’re currently with T-Mobile or have been with Metro in the past 180 days. Fastest: Based on analysis by Ookla® of select Prepaid Wireless providers Speedtest Intelligence® data for the U.S., 1H 2024. Ookla trademarks used under license and reprinted with permission.